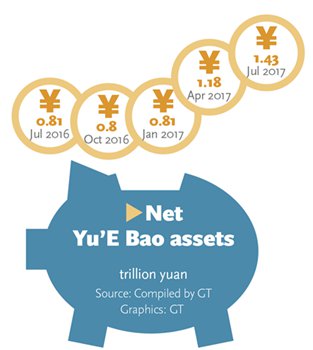

(Graphics/GT) Yu'E Bao, a fund management service for individual investors owned by domestic Internet titan Alibaba Group Holding, has attracted funds of more than 1.43 trillion yuan ($211 billion) under management by the end of June. Experts said that the growth of Yu'E Bao showed that the Internet finance industry is profoundly reshaping China's traditional financial landscape. Tianjin-based Tianhong Asset Management Co, which manages Yu'E Bao's assets, said on Friday that the fund had 1.43 trillion yuan under management as of the end of June, up from 1.14 trillion yuan at the end of the first quarter. The figure is now close to the balance for demand deposit accounts of 1.63 trillion yuan with Bank of China in 2016, and it has surpassed the 1.3 trillion yuan total of demand deposit and term deposit accounts with China Merchants Bank, which is known for its retail banking service, according to media reports. On the basis of the current growth rate, the funds under management at Yu'E Bao are expected to surpass the average individual deposit balance at Bank of China in 2016 by the end of September this year, industrial website fund.jrj.com.cn forecast on Saturday. Li Chengdong, a Beijing-based independent industrial analyst, noted that the easy operation, relatively high interest rate and low investment threshold offered by Yu'E Bao will continue to drive the fund management service's momentum in the future. "The rising Internet finance sector is changing and also challenging China's traditional financial services industry," Li told the Global Times on Sunday. The number of Yu'E Bao users surpassed 300 million by the end of March, Tianhong said in a report posed on its website on April 22. Most of Yu'E Bao's investors are individuals who can easily put savings into Yu'E Bao through Alibaba's third-party payment tool Alipay. "The link with Alipay offered a wide channel for Yu'E Bao's advance," Li said. "Yu'E Bao is quite convenient as it has no minimum amount of investment, and customers can withdraw their money at any time," 20-something white-collar worker Julia Zhang told the Global Times on Sunday. "I always put my salary there as Yu'E Bao offers an automatic service for transfer of salary," Zhang said, adding that the relatively high yield from Yu'E Bao was another attraction. Yu'E Bao's rising yield this year has attracted a lot of attention in the domestic market. Its seven-day annualized yield surpassed 4 percent on May 11, according to Zhang. The seven-day annualized yield of Yu'E Bao is currently about 4.16 percent, while the annual yield from an ordinary demand deposit account at a bank is around 0.35 percent. Risks and pressure Created in 2013, Yu'E Bao overtook JPMorgan's U.S. government money market fund, which has $150 billion under management, to become the world's largest money market fund in April, media reports said. China's money market fund industry, which is merely a decade old, has been developing quickly, thanks to increasing demand for online funds managed by Internet firms such as Alibaba, Tencent Holdings and Baidu Inc, experts said. "However, the rapid development of the money market fund industry shows that the financial services offered by China's banks need to be improved," Li noted. The growth of the sector also poses certain risks for the domestic financial system as regulators might not know about some capital flow information from Yu'E Bao, which has a different clearing channel from domestic banks, Guo Dazhi, research director with the Zhongguancun Internet Finance Institute, told the Global Times on Sunday. Guo also said that the large investment in online platforms will put pressure on traditional banks. Over 64 percent of the funds that Yu'e Bao invests go into bank deposits, while the rest go to short-term investments, policy bank bonds, company bonds and interbank deposits, news portal caixin.com reported in April. |

Powered by Discuz! X3.4

© 2001-2013 Comsenz Inc.